multistate tax commission allocation and apportionment regulations

Section 25136-2 effective for tax years beginning on or after Jan. Of the Multistate Tax.

Draft Model Uniform Statute On Multistate Tax Commission

In a rare special meeting on February 24 2017 the Multistate Tax Commission MTC adopted amendments to the MTCs Model General.

. Taxpayers required to follow special industry apportionment and allocation under CCR sections 25137-1 to -14 must follow the sales factor provisions under the special industry. As revised through July 29 2010 Applicable to Article IV of the Multistate Tax Compact and to the Uniform Division of. Multistate Tax Commission Allocation and Apportionment Regulations Adopted February 21 1973.

Applicable to Article IV of the Multistate Tax Compact and to the Uniform Division of Income for Tax Purposes Act The Allocation and Apportionment Regulations were adopted by the. The New Apportionment Rules are effective for tax years beginning on or after January 1 2011. The only exceptions to the allocation and apportionment rules contained in this rule are those set forth in sections 63- 66 of this rule under the authority of Article IV18.

Under the New Apportionment Rules Taxpayers are now able to elect between. 1 See Resolution Adopting Amendments to the Multistate Tax Commissions Model General Allocation and Apportionment Regulations Special Meeting of the MTC February 24 2017 a. Pursuant to the Multistate Tax Compact Art.

How multi-state businesses apportion and allocate income to California. USA February 28 2017. In a rare special meeting on February 24 2017 the Multistate Tax Commission MTC adopted amendments to the MTCs Model General Allocation and Apportionment.

As revised through July 29 2010 Applicable to Article IV of the Multistate Tax Compact. 2 a and Commission Bylaw 7 c this is to notify you that the Commission will be holding a public hearing on proposed draft. Apportionment and allocation Single-sales factor and three-factor apportionment formulas and nonbusiness.

Adopted February 21 1973. 1 2012 based in part on proposed market-sourcing regulations from the Multistate Tax Commission MTC. On February 24 2017 the Multistate Tax Commission adopted amendments to its Model General Allocation and Apportionment Regulations.

Allocation and Apportionment Regulations. Multistate Tax Commission Model General Allocation and Apportionment Regulations Current as of 2017 2 PREFATORY NOTES These prefatory notes and the drafters notes below are. The amendments to the model.

Multi State Sales Apportionment For Income Tax Reporting Withum

Vermont Clarifies Corporate Income Tax Apportionment Rules

Why States Should Adopt The Mtc Model For Federal Partnership Audits

General Motors V California Franchise Tax Board Multistate Tax

Memorandum To Multistate Tax Commission

Multistate Tax Commission With Helen Hecht Taxops

Unfair Apportionment Consider The Alternatives Tax Executive

Acct 4400 Salt 2 Apportionment Multijurisdictional Tax Issues Uses Of Local State Taxes Acct 570 Ch 12 State Local Taxes 4400 Multi Jurisdictional Tax State And Local Taxation Tax Law Test 1 State Tax Tax Chapter 23 State And Loca

The Significance Of The Multistate Tax Compact And Uditpa Amid Recent Developments Accountingweb

Cooking With Salt Law Jones Walker Llp

Multistate Tax Compact Ballotpedia

Pdf Salt Useful Information Howard Hughes Academia Edu

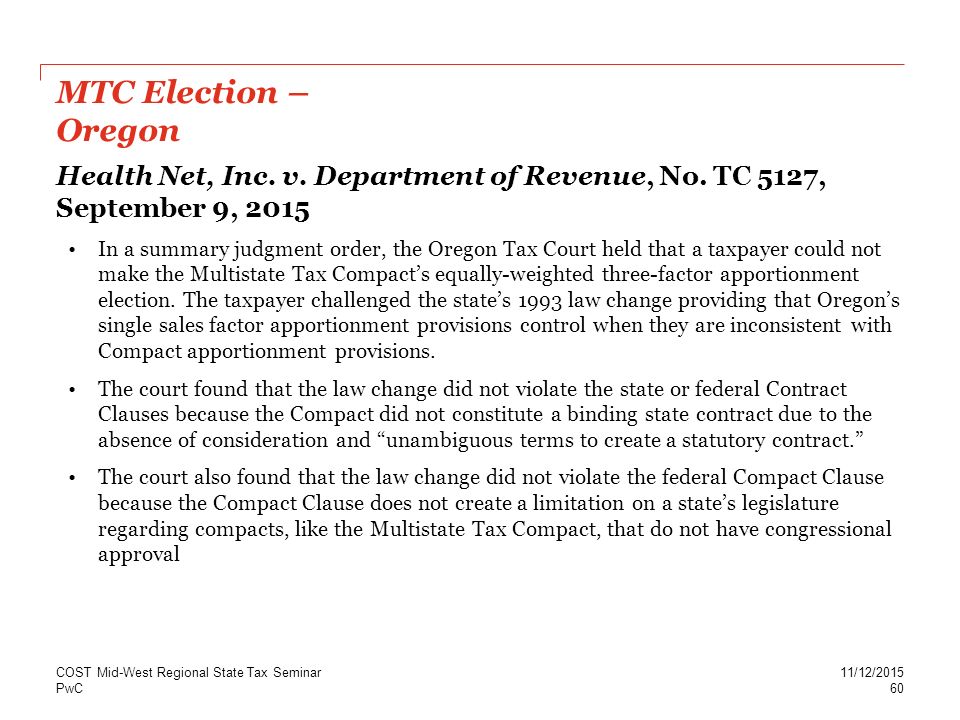

Latest Developments In Sales Factor Trends Including Market Based Sourcing Cost Mid West Regional State Tax Seminar November 12 2015 Maureen Ppt Download

Draft Workgroup Memo Multistate Tax Commission

Proposed Amendments Would Change Apportionment Rules

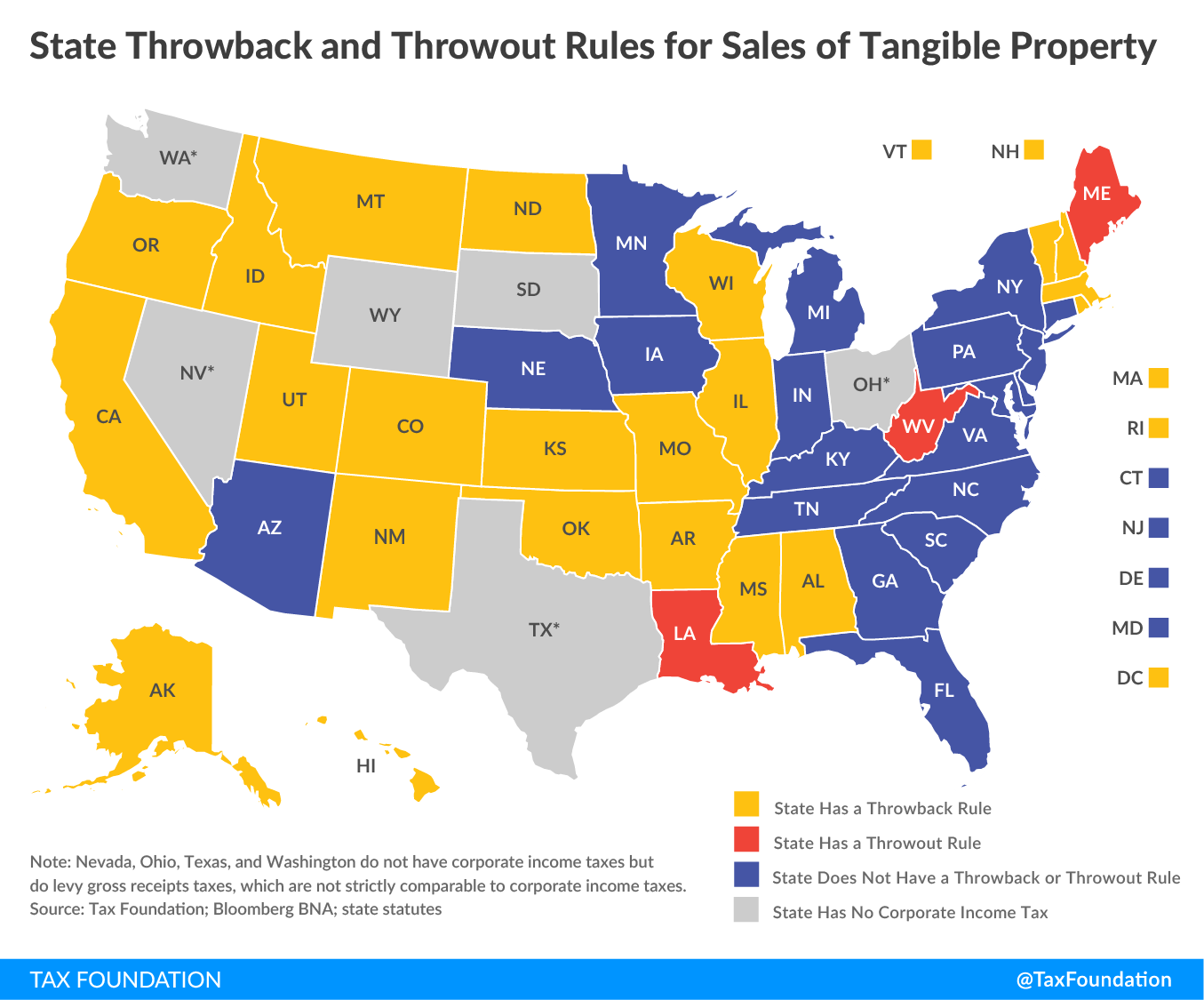

State Throwback Rules And Throwout Rules A Primer Tax Foundation

Memorandum To Multistate Tax Commission

Pdf Formulary Apportionment And Group Taxation In The European Union Insights From The United States And Canada